Cannabiz Media has found many commonalities and differences in the states that have approved medical marijuana through its analysis of qualifying medical conditions. Once a ballot measure is approved or a governor signs a bill making medical marijuana legal in a state, the real work begins to craft and refine the qualifying conditions and regulations that define the medical marijuana economy within that state. These regulations significantly affect cultivation, production, dispensary and other supply-chain license valuations.

Overview

In total, 57 qualifying medical conditions have been approved for marijuana treatment across the 26 states tracked by Cannabis Media, plus the District of Columbia, where patients can legally purchase, grow and/or use medical marijuana. These conditions cover diseases and symptoms as well as complications the illnesses and/or their treatments caused. For example, patients in most of these states may be treated with medical marijuana for diseases such as cancer and HIV/AIDS as well as for symptoms of chronic pain and/or side effects of treatment such as nausea.

Valuation Considerations

– Age of population in a given state and a propensity of that population to suffer from approved conditions;

– Length of time legislation and registration/dispensary programs have been up and running in a state;

– Propensity of a state to approve additional medical conditions (such as chronic pain, PTSD, insomnia, depression, anxiety, opioid addiction, etc.);

– If the federal government legalizes medical marijuana, will doctors then begin prescribing it rather than recommending it or certifying a patient for its use? And if so, will pharmacies begin carrying medical marijuana products? Will health insurance companies then be required to cover medical marijuana as a prescription drug? Currently, no state requires health insurance companies to cover the cost of medical marijuana.

– What impact will recreational marijuana have on medical marijuana?

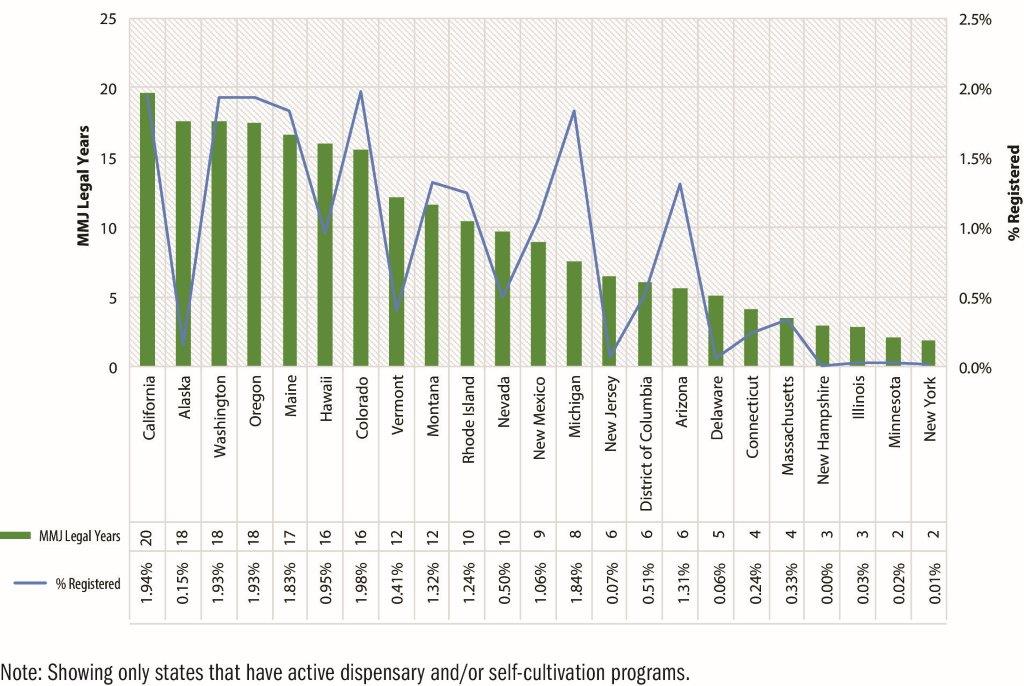

On average, 0.86% of the populations in these medical marijuana-approved states are accessing, or registered to access, medical marijuana to treat their conditions. The estimated use of medical marijuana, based upon registration data and the number of recommendations issued by medical doctors, ranges from nearly 2% in states such as California, Colorado, Oregon and Washington to lower than 0.1% in states such as Delaware, Illinois, Minnesota, New Hampshire, New Jersey and New York. Not all states require registration in order for patients to legally purchase and/or use medical marijuana.

Usage estimates are sometimes derived from voluntary reports by medical professionals on the number of patients for which recommendations have been provided or on other data available.

Based on Cannabiz Media’s research data, the quantity and quality of qualifying medical conditions play a significant role in the value of a medical marijuana license for cultivation, production, and/or dispensing as discussed in these key observations:

– Fifty-seven qualifying conditions (including any condition for which a medical doctor expects to have improved outcomes with marijuana treatment, as permitted in five states) have been approved for marijuana treatment across the 26 states and the District of Columbia tracked by Cannabiz Media where patients can legally use medical marijuana.

– Four qualifying conditions account for a vast majority of the medical marijuana recommendations being made: chronic pain, muscle spasticity, spinal cord injuries and post-traumatic stress disorder (PTSD). These four conditions may, by their inclusion or exclusion, directly affect the value of cultivation, production and dispensary licenses within a state.

– Of these four key qualifying conditions, the majority of patients across the country (59%) receive medical marijuana authorizations for chronic pain.

Qualifying Conditions

In total, 57 qualifying conditions have been approved for marijuana treatment across the 26 states and the District of Columbia tracked by Cannabiz Media where patients can legally access medical marijuana.

Nationwide, there is a wide range in the scope of approved conditions. Illinois qualifies the greatest number of conditions, at 37, while Alaska, Colorado and Vermont approve only nine and Florida and Missouri approve only one (epilepsy).

On average, most states cover 12 to 15 conditions. In some states, the process for getting an additional condition approved is relatively easy — as easy as sending a request to the program administration. In Connecticut, for example, any person can submit a petition, though there is no guarantee of approval. In other states, the task of getting additional conditions approved is onerous and requires various panels to research and forward requests until they make their way through the state legislature and onto the governor’s desk. Some states, such as New Jersey, are just now putting their new condition approval processes in place.

Exhibit 1 shows how many conditions are covered in each state.

One might think that a larger number of qualifying conditions would encourage a larger number of medical marijuana patients, registrants and/or doctor recommendations and thus a larger consumer market. However, Cannabiz Media found that a number of variables in addition to the number of conditions approved will impact the total number of medical marijuana patients in a state, as well as the potential sales and profitability of a cultivator, producer or dispensary license.

Along with the quantity of conditions approved, a license valuation must also account for:

– Maturity of the cultivator, producer, dispensary license program;

– Which specific conditions the state has approved;

– Relative likelihood that additional specific conditions will be approved; and

– How many approved medical professionals are writing recommendations for medical marijuana to their patients.

This list does not include all variables to be considered in the valuation of a license. It is merely a list of some of the variables that are most closely associated with the impact that the quantity and quality of qualifying medical conditions can have on the value of cannabis business licenses within a particular state.

If only the quantity of approved conditions were taken into account, Illinois, which covers 37 conditions (far more than any other state), should have the highest number of medical marijuana patients. This, however, is not the case.

Exhibit 2 shows the number of conditions covered by each state compared to the number of medical marijuana patients in each state (as a percentage of each state’s total population) and the duration of the medical marijuana dispensary program.

Despite covering 37 conditions, just 0.03% of Illinois residents are registered medical marijuana patients. Conversely, only nine conditions are approved in Colorado for medical use, but 1.98% of the state’s population are medical marijuana registrants.

Part of the explanation, of course, is that Illinois has a relatively young medical marijuana program. Its first dispensary didn’t open until November 2015, while medical programs in other states started being implemented in 1996.

Most states cover 12 to 15 conditions as the scatter diagram in Exhibit 3 shows. Outliers such as Illinois (on the high side) and Vermont (on the low side) exist, but the number of medical marijuana registrants does not increase or decrease proportionately with the number of conditions covered by these outlier states.

Exhibit 3. Correlation Between Number of Conditions and Percentage of State Population Registered

Top Four Conditions

Chronic pain, muscle spasticity, spinal cord injuries and PTSD account for a vast majority of the medical marijuana recommendations being made. These four conditions may, by their inclusion or exclusion, directly affect the value of cannabis business licenses within a state. Across the states where medical marijuana is legal, 57 conditions could qualify patients for medical marijuana recommendations. Exhibit 4 provides all of the details.

Exhibit 4. Number of States (of 27 Tracked) Covering Each Condition

It would appear that conditions covered in more states would generate a higher number of registrants for those conditions. However, that’s not the case. Exhibit 5 shows the percentage of medical marijuana registrants across the country for each condition (of those states that report the data).

Exhibit 5. Percentage of Patients Citing Condition

Despite the fact that cancer, multiple sclerosis, epilepsy/seizure conditions and HIV/AIDS are the most widely approved conditions among all of the states, each covered in at least 24 states, none are the most common conditions for which people get medical marijuana approvals. In fact, none of them are even in the top five. Instead, they rank sixth, eighth, ninth and 17th, respectively.

Comparing the number of conditions covered to the number of medical marijuana registrants by condition in Exhibit 6 shows that four approved qualifying conditions account for the most medical marijuana patients across the country.

Exhibit 6. Number of States Covering a Condition v. Percentage of Registrants Worldwide

As Exhibit 6 shows, 59.2% of all medical marijuana registrants across the country received their medical marijuana recommendations to treat chronic, severe or intractable pain (approved in 23 states). Another 19.4% of medical marijuana patients are registered for muscle spasticity (21 states) and 13.4% are registered for spinal cord injury or disease (six states). Rounding out the top four conditions is PTSD (15 states), with 12.5% of registrants. In other words, one condition accounts for the vast majority of all patients and four conditions account for nearly all applicants. The other conditions make up a very small fraction of all medical marijuana registrants across the country.

Based on the data, it’s clear that states that don’t cover chronic pain could be limiting the size of the market and the value of marijuana licenses in those states.

It’s important to note that just because a state has approved certain conditions doesn’t mean patients are actually getting recommendations for those conditions. Consumer demand might be prevalent, but doctors are the gating factor in all states where recreational marijuana is illegal. Many doctors are, for numerous reasons, reluctant to recommend medical marijuana for their patients. Not least among these reasons is that marijuana, in any form, is still a Schedule 1 controlled substance in the eyes of the United States government.

In five of the states Cannabiz Media tracked in this report, one of the approved conditions is, to paraphrase, any condition for which the doctor believes medical marijuana would be beneficial to the patient. These states are: California, Maryland, Massachusetts, New Hampshire and Washington, D.C. Despite this latitude, most doctors appear unwilling to go off of the list of specific approved conditions.

In many states, some doctors appear to limit the number of medical marijuana recommendations they will make for fear of being labelled a “pot doctor” and meriting additional attention from state, federal and medical board authorities. The possibility of losing their license (or their malpractice insurance) is often a compelling argument against fully embracing the potential medicinal value of cannabis for their patients.

Only Alaska, Colorado, Washington, Oregon and Washington, D.C., have legalized marijuana for recreational use (California, Nevada, Maine and Massachusetts have legalized recreational marijuana, but the rules have yet to be fully implemented following the 2016 election). If doctors or regulations prevent people from accessing medical marijuana, then dispensary sales will be negatively impacted, as will the value of licenses in that state.

Doctors do not write prescriptions for medical marijuana in any states; instead most states have doctors write a medical recommendation or a certification for medical marijuana treatment. Nevertheless, patients may find many doctors unwilling to provide such documentation until the federal government changes the classification of marijuana.

For example, Connecticut is one of only two states that have approved all of the top four qualifying conditions, but only 0.24% of the state’s population is certified to receive medical marijuana. New Mexico is the other state that has approved all of the top conditions and 1.05% of its population is accessing medical marijuana. Factors contributing to the difference are likely to be that Connecticut’s medical marijuana program was made legal in May 2012, while New Mexico legalized medical marijuana in July 2007. Further, Connecticut only recently added chronic pain as an approved condition.

Over time, we may see that the longer a medical marijuana program is in place, the more willing doctors are to provide recommendations to their patients. And, as in Connecticut, the longer a program is in place, the more likely skeptical legislatures and governors will add additional conditions.

It is important to note that even states that have legalized recreational marijuana often continue to maintain medical marijuana programs (sometimes providing patients with exemptions from sales tax, the ability to possess or purchase more cannabis than a recreational user, etc.). In some of these states, the number of patients registered in the medical marijuana program will decline simply because there are alternative venues for procurement available. For example, the number of estimated registered patients in Alaska decreased from 1,857 in October 2014 to 1,132 in March 2016, likely as a result of the legalization of recreational marijuana in the state in November 2014.

Therefore, the data should not be analyzed in isolation. Many other factors other than the breadth and width of approved medical conditions affect the value of a medical marijuana license.

Chronic Pain

The majority of registrants across the country received medical marijuana recommendations for chronic pain. However, the value of a license is not completely linked to whether or not a state has approved medical marijuana for that condition.

Upon first glance at the data, it would appear that states must approve chronic pain in order for marijuana licenses within those states to be highly valuable. However, a closer look reveals that license value isn’t all about chronic pain. Exhibit 8 shows the breakdown of registrations for several conditions within those 12 states that report this information.

Exhibit 8. Three Conditions Across 12 Reporting States

As discussed previously, chronic, severe and intractable pain is the most common condition for which registrants receive medical marijuana certifications, followed by muscle spasticity, spinal cord injury/disease and PTSD, respectively.

In Arizona, almost 79% of all patients are certified for chronic pain. In Michigan, that number reaches almost 93%. In several other states, however, where chronic pain is an approved condition, far fewer patients receive certifications for it. Both Minnesota and New Jersey are examples, where chronic pain accounts for 0.0% and 25.8% of registered patients. Instead, more people in both of these states receive medical marijuana certifications for muscle spasticity, which accounts for 39.3% and 34.4% of patient registrations.

In both cases, a large percentage of the consumer population (based on registration penetration levels from other states) isn’t being served. Considering that only 0.02% of the Minnesota population and 0.07% of the New Jersey population are registered to obtain medical marijuana, it’s interesting to consider how actually providing certifications for chronic pain would positively affect the number of registrants in both states. However, both markets are relatively new (Minnesota legalized medical marijuana in May 2014 and New Jersey did so in January 2010, but didn’t open its first dispensary until December 2012) and it is possible that doctor and patient familiarity and comfort with medical marijuana in general, and its use for chronic pain and other conditions, will increase overall usage.

In New Mexico, most registrants receive certifications for PTSD (45.9%) despite the fact that chronic pain (29.3%) is an approved condition in the state. While New Mexico does have 1.06% of its population registered to receive medical marijuana, the market could be much larger if the number of people certified for chronic pain increased.

Conclusions

Looking at the available data related to approved qualifying conditions, states that are likely to have more valuable marijuana licenses are those that cover the top four conditions (or at least one of them), have large populations that increase the market size, and have greater than the average penetration rate of 0.85%, which shows traction and room for growth.

[contextly_auto_sidebar]